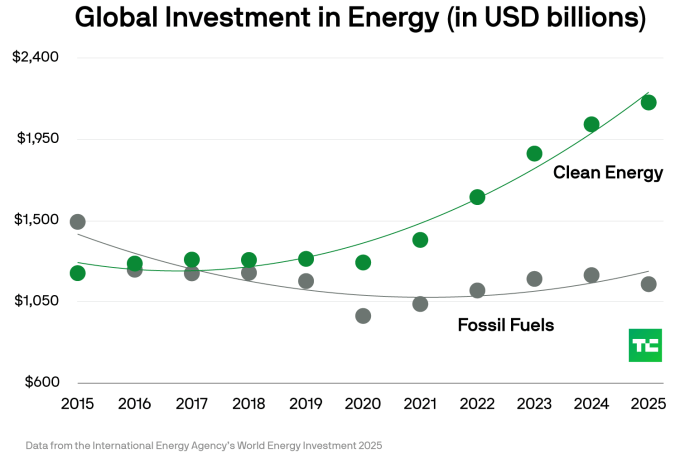

The global landscape of energy investment is undergoing a remarkable transformation, with clean energy now poised to attract nearly double the funding compared to fossil fuels this year. This shift is highlighted in a recent report from a leading energy agency, indicating a significant pivot towards sustainable energy solutions.

While investments in fossil fuels remain substantial, estimated at around $1.15 trillion for the current year, they pale in comparison to the anticipated $2.15 trillion earmarked for clean energy initiatives by 2025. This stark contrast underscores a pivotal moment in the energy sector, where the momentum for clean energy continues to build.

Analyzing the investment trends reveals a compelling narrative. Over the past decade, fossil fuel investments have shown a steady, albeit slightly declining, trajectory. Although there was a brief resurgence following a dip during the pandemic, recent data suggests a softening in fossil fuel investments this year.

In contrast, the trajectory of clean energy investments is markedly different, showcasing a robust upward trend. The data indicates a clear and aggressive growth pattern, suggesting that the transition to renewable energy sources is not just a temporary phase but a long-term commitment.

For those interested in the numbers, a second-order polynomial analysis of fossil fuel investments reveals a reasonable correlation (R2 = 0.74), indicating a potential for continued extraction of oil, coal, and gas in the near future. However, applying the same analytical approach to clean energy investments yields a much stronger correlation (R2 = 0.94). Unless there is a significant reversal in trends — which has not occurred in the last decade, even during the pandemic — we can expect even larger clean energy investments in the coming years.

The pressing question remains: will these investments be sufficient to meet global energy demands?

To achieve net-zero emissions by 2050, the world must ramp up its annual investments to an average of $4.5 trillion, as highlighted in a report from a prominent economic organization. This figure is double the current investment levels, which may seem daunting. However, analysts have previously underestimated clean energy investment forecasts, and the latest data suggests that reaching this goal is increasingly feasible.

While the rapid growth of clean energy may not be sustainable indefinitely, similar patterns have been observed in the past, particularly in the mid-2010s. The adoption of new technologies often experiences fluctuations influenced by global economic conditions and the challenges companies face in integrating these innovations.

Looking ahead to 2050, it is likely that average annual investments will meet or even surpass the $4.5 trillion target set by the economic organization. As clean energy technologies become more affordable, their accessibility increases. Notably, a significant portion of electricity demand growth in the next two years is expected to stem from developing and emerging economies, where solar and wind energy are becoming increasingly viable alternatives to traditional coal.

One unpredictable factor in this equation is the demand from data centers. In the United States, utilities are grappling with uncertain demand forecasts, which may lead to a scramble for additional power sources. Some may opt for gas turbines, while others may invest in nuclear energy. However, in the coming years, and likely in the long term, renewable energy combined with energy storage solutions is expected to dominate the market. Their decreasing costs and modular nature make them attractive options for investors, as they can be deployed at various scales and prices, ensuring widespread availability.